Successfully managing debt can feel like a daunting task, but it's absolutely achievable with the right strategies and a commitment to action. The first step is to achieve a clear picture of your monetary situation. Collect all your debt information, including balances, interest rates, and minimum payments. Once you have a comprehensive understanding of your finances, you can start to develop a personalized plan for reduction.

Consider various debt consolidation strategies, such as the snowball or avalanche methods. These approaches can help you rank your debts and create a realistic payment schedule. It's also important to establish a budget that allows for consistent debt allocations. By tracking your expenses and locating areas where you can reduce spending, you can free up more funds to allocate towards debt repayment.

- Seek professional guidance from a credit counselor or financial advisor. They can provide personalized advice and help you navigate complex debt situations.

- Converse with your creditors to explore potential settlement options, such as lower interest rates or modified payment terms.

Keep in mind that conquering debt is a marathon, not a sprint. Stay dedicated to your plan, and celebrate your progress along the way.

Financial Foundations: A Roadmap for Immigrant Success

Building a solid financial foundation is essential for the success of any immigrant integrating into a new country. It provides assurance and empowers individuals to navigate the obstacles they may face.

Developing a comprehensive financial plan requires a variety of steps. First, it's important to grasp the local market. This includes acquiringknowledge with banking practices, credit options, and fiscal regulations.

Additionally, immigrants should prioritize building an emergency fund to alleviate unexpected expenses. Simultaneously, it's prudent to research asset growth channels that align with their objectives.

Navigating Debt Management in Unfamiliar Territory: Tips for Newcomers

Stepping into the world of debt management can feel daunting, especially if you're a newcomer. It's common to feel a sense of anxiety when facing unexpected financial burdens. However, don't worry. Taking the opening steps towards understanding your debt can provide a significant difference in your overall financial health.

Here are some essential tips to help you conquer this challenging territory:

* Create a comprehensive budget. Track your revenue and expenses to get a clear overview of your financial standing.

* Rank your debts based on annual percentage rate. Focus on eliminating the greatest interest debts initially.

* Consider different debt consolidation options. You may explore debt consolidation loans, balance transfers, or credit counseling services to help you control your debt more effectively.

* Discuss with your creditors. Explain your financial hardship and see if they are willing to negotiate your payment terms.

Remember, taking ownership of your finances is a process approach. Be patient with yourself, acknowledge your progress, and don't hesitate to request professional guidance when needed.

Financial Guidance : Your Guide to Stability Abroad

Navigating fiscal matters in a new country can be daunting. Social differences often affect budgeting and expenses, making it important to seek sound counseling. Credit counseling organizations provide professional support tailored to your needs.

They can advise you with creating a spending strategy, managing indebtedness, and comprehending the unique financial environment of your new residence.

By empowering you with understanding and practical tools, credit counseling can cultivate financial stability across your journey abroad.

Building Credit and Managing Debt as an Immigrant

As a newcomer to this land, creating credit can feel like navigating uncharted territory. It's essential for accessing credit cards, which are necessary for financial stability. However, without a traditional credit score, it can be difficult.

Thankfully, there are steps you can take to establish a positive credit profile. One important step is to open a secured credit card. These options need a security deposit, which reduces the lender's risk. Making timely payments is vital to building your credit score.

Managing debt is equally critical for economic stability. Create a spending plan that distributes income to needs, credit card bills, and future investments.

Explore strategies for debt reduction, such as {balance transfers, debt consolidation loans, or credit counseling services|. Remember, understanding your finances is power in building a secure financial future. Bone Health During Menopause

Methods for Overcoming Financial Challenges in a New Country

Moving to a new country can be an exciting adventure, but it often presents unique financial challenges. Adjusting to a new cost of living, familiarizing unfamiliar banking systems, and building a stable financial foundation takes careful planning and smart decision-making.

Here are some crucial strategies to help you overcome these hurdles:

* Explore the local cost of living before you move.

* Create a budget that accounts for all your expenses.

* Find out about available government programs for newcomers.

* Build relationships with other expats to share knowledge.

* Learn the basics of the local money market.

Remember, financial challenges are common when moving in a new country. By adopting these methods, you can overcome these hurdles and build a secure financial future.

Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Mary Beth McDonough Then & Now!

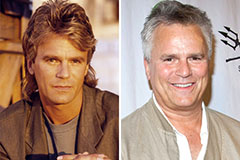

Mary Beth McDonough Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!